The Most Boring Article About Financing a Business You’ll Ever Read

Introductions

How much does it cost to start a business? Is it worth the risk? What kind of return can I expect? These questions are important to ask before starting a new venture.The costs associated with starting a business vary widely depending on the type of business you want to launch. Some businesses require little capital investment, while others require significant amounts of cash upfront.

You should consider the risks involved in starting a business before investing your money. There are several ways to finance your business. This article explains the pros and cons of each option.

How to Financing a Business

In order to realise your small commercial enterprise dreams, you’re going to want a manner to finance a commercial enterprise. Starting up and going for walks your personal small commercial enterprise calls for ok capital to open the ones doorways on the primary day after which eventually, flip a profit.

There are heaps of various kinds of small businesses. Each small commercial enterprise is precise in its personal manner. However, one not unusualplace thread that runs thru every and each small commercial enterprise—irrespective of what type—is the want for ok investment. Do you want a commercial enterprise loan? Should you are taking out a conventional loan? Find a credit score union? Check out on line rates? What’s the distinction among the three?

We will stroll you thru a extensive degree evaluation of what you want to recognise approximately the numerous methods you could finance a commercial enterprise. With the right education, planning, and preparation, you’ll be prepared to take the important steps to locate and stable the exceptional investment in your small commercial enterprise.

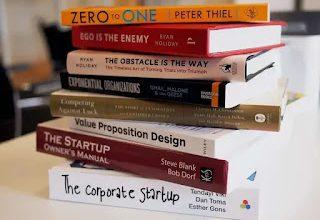

You Need a Business Plan

The first actual step of exploring approaches to finance a commercial enterprise is making plans the way to do so. All new businesses, from one-man or woman on-line stores to multi-worker massive corporations, want first of all a sincerely drafted, thorough marketing strategy.

The truth is that your commercial enterprise isn’t going to get investment from both a lender or investor except you’ve got got a marketing strategy to reveal to potential creditors or buyers. Prospective creditors or buyers will want to look that they may be paid back. Investors will want to look that the capital they sunk into your commercial enterprise

1.WHAT IS THE NEED FOR YOUR BUSINESS PLAN TO PROSPECTIVE LENDERS?

Your company strategy gives you the opportunity to explain and consider:

- Business’s entrepreneurial objectives

- Financial projections for the company

- Plans for future growth and expansion of the business

Preparing your business plan allows you to manipulate the numbers on paper so that you can mentally plan ahead to avoid problems and take advantage of openings.

A business plan can be presented to implicit investors or prospective lenders as substantiation that your company is good of backing, therefore helping your business decide that loan. Preparing a written business plan demonstrates to implicit lenders that your business idea makes sense and that the figures add up.

2.PROJECT YOUR BUSINESS’S NEEDS BY CRUNCHING THE NUMBERS

Your business plan can serve as a fiscal roadmap for internal use. Use a business plan to show how you ’re going to use your loan or investment finances to their maximum eventuality.

Your business plan allows you to project the backing that you’ll need. You can also figure out how to stylish optimize that backing for a maximum return on investment. Also, your fiscal roadmap lays out how you plan to use the backing plutocrat.

3.LENDERS WILL CAREFULLY REVIEW THE SALES PROJECTIONS IN YOUR BUSINESS PLAN.

At the end of the day, your business will only be profitable if it’s suitable to make deals. One of the most important effects investors will concentrate on in your business plan is your business’s unborn trade protrusions.

Your business plan’s deals protrusions should include all costs, allocation of coffers, as well as data on how financially doable your business idea is. Preparing and examining prospective deals numbers will show whether the business will sink or swim during the each-important launch- up phase.

Steps to Help You Get Your First Small Business Loan

Now that you ’ve prepared your written business plan and examined whether the figures make sense, it’s time for you to use that plan to help you secure a loan for your company.

The nethermost line You ca n’t start a business without enough plutocrat. utmost small businesses are funded by loans, either incompletely or completely. Taking out a loan requires you to prepare the proper attestation.

So how do you actually get a small business loan? Then are the introductory tips to know to take you from pending operation to quick blessing

1.You must prepare the necessary documentation in order to obtain a business loan.

Prepare proper documentation for the loan application.

Check with the prospective lender on what they need from you.

Be honest with your answers on the application.

Be accurate with your numbers and projections.

Answer all the questions completely.

Don’t overestimate your business’s potential profits.

Don’t underestimate your business’s anticipated expenses.

Also, don’t apply to borrow more money than you can reasonably payback.

2.Examine SBA resources and materials related to loan applications.

The Small Business Administration( SBA) is a civil association that was created to help small businesses and their possessors realize their entrepreneurial dreams. A thing of the SBA is to give aspiring and being entrepreneurs with the training, tools, and coffers they need to get their businesses off the ground, and also how to turn it into a profit- making successful adventure.

The SBA is full of coffers on how to apply for and secure your first business loan. VisitSBA.gov for interactive, up- to- date information on the small business lending geography. Your business may qualify for special programs and rates, depending on who owns the company and what assiduity you ’re in.

3.CONSIDER THE VARIOUS LOANS AVAILABLE TO SMALL BUSINESSES

You can get assistance from the SBA in creating your small business loan application as well as learning about favorable rates and unique loan options. For more information on potential programs, go to SBA.gov.

Loans from Traditional Banks for Those With Good Credit

Traditional bank loans go entrepreneurs with favorable credit scores and credit history the chance to finance a business from a traditional lending institution.

Loans from traditional lenders may vary in terms of duration and yearly payment quantities, so you ’ll want to be conscious of the quantum of interest charged over the life of the loan. It’s pivotal to make payments on time, or differently your credit will be harmed.

Business Possessors with no credit or poor credit scores may still qualify for a traditional bank loan if they apply with a cosponsor. A loan cosponsor pledges to make the loan payments if you can not, which can help you qualify for loan blessing if you can not do so on your own.

Some banks also consider the matter of collateral for a traditional loan. Collateral is when precious palpable particular property is proffered by the lendee to secure theloan.However, the bank will seize the property and vend it to pay for the overdue balance on the loan, If the lendee fails to make payment on the loan. Some business possessors use their homes as collateral for a business loan, though that option isn’t without significant threat.

Microlenders Offer More Flexible Approval Conditions

Microlenders offer small business possessors a way to finance a business that differs from traditional banks. Microlenders ’ advancing criteria are generally more flexible when it comes to approving campaigners who may not qualify for traditional bank loans due to lack of credit or poor credit history.

The distinction between a traditional bank and a microlender is that microlenders take a holistic approach to the lending process. Rather than a traditional bank, which focuses on data and figures, a microlender will frequently take a more particular approach to lending when reviewing loan operations and making opinions on campaigners.

How to Finance a Business

Funding a small business adventure may bear outside backing to get the business off the ground. The good news is that there are numerous backing options that live to help small business possessors with their new business capital requirements.

Securing the right backing for your small business will take some exploration and some legwork, but know that colorful accessible options do live to fund your small business. Since taking out a business loan is a huge fiscal and legal commitment, you should be sure you understand all of the documents and terms of the loan before you subscribe.